When it comes to saving money, we all have good intentions, right? We often give ourselves false hopes that we will save after we reach a specific milestone. This could mean different things for different people. Some would save after they get a raise, others save based on their age or when Paul finally moves […]

Financial Tips to Avoid Going Broke During the Holidays

The holiday season is waiting in the wings of fall. Depensading on how many friends, family members, and co-workers are on your list, you may have several people to buy gifts for. If you aren’t careful, you can easily start 2020 deep in debt, a fact that most certainly will not leave you smiling at […]

Fintech Companies, Banks, & the Future of Prepaid Credit

Technology has come to affect almost every aspect of our lives. It is no surprise that technology would begin to change the financial sector. Two of the most profitable industries in the modern economy are converging, and banks can either embrace this change or resist it. If banks choose to resist it, they will likely […]

When is the Right Time to Take a Loan?

Even when you know plenty of details about loans, you may not have a strong hold on when a good time to take one out is. Fortunately, taking a good look at your situation and evaluating some specific factors can help you to decide if now is a good time to apply. Emergency Repairs and […]

Ways to Make Your Money Grow

As a man, you’re expected to be independent and self-sufficient. This is especially true if you’d like to get married and start a family. Plus, there’s nothing like having the ability to rely on yourself financially. Unfortunately, there are many men who don’t receive the financial tools to manage money or make it grow. It’s […]

6 Ways to Finance Your Entrepreneurial Endeavor

If you’ve been considering starting a small business that you believe in you may find yourself running into one major snag which many new entrepreneurs encounter — how to find the funding you need to get off the ground. Starting a new business can be a costly endeavor, with even the most well-planned businesses still […]

How to Entertain Guests on a Budget

Whether you are hosting a big celebration coming up or you simply love entertaining, you want to be able to make the most of the moment without breaking your budget. This can be easier said than done when you add the food, drinks, and other expenses into the mix. But if you plan it the […]

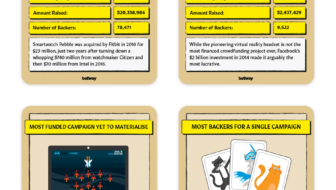

What Can Kickstarter Success Stories Teach Us About Investment?

Probably the greatest impediment to prevailing in business is venture. On the off chance that your capital was boundless, your business would in the long run succeed, regardless of how you went about it. Nonetheless, the vast majority have spending plans running from shoestring to unobtrusive and need to guarantee that each penny is put […]