As if keeping track of your finances when it comes to paying bills, saving for emergencies, let alone saving for retirement is not hard enough, credit should not be overlooked, and is just as important, and in most cases, goes hand in hand. Your credit is the primary factor that lenders can look at to […]

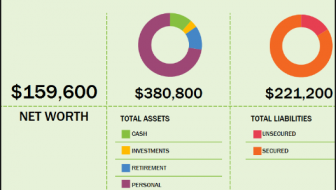

An Overview of Personal Net Worth and Its Effect on Your Finances

If you’ve been paying attention to the world of finance, you’ll most likely have come across Forbes list of the richest people in the world. The people on that list are the crème de la crème controlling most of the global wealth with net worth running into billions of dollars. Most people will never get […]

Six Affordable Gifts to Consider Buying This Mother’s Day

Finding the perfect gift to give your mom for Mother’s Day is not always easy to do. Your mom is special to you and she should receive a gift that is just as special. Avoid giving her the same old chocolates and flowers by using the following guide to learn a few options to consider […]

5 Ways to Achieve Your Financial Goals

Mortgages, car payments, family financial obligations and more money woes could make it seem dauntingly impossible to create a secure financial future any time soon. The average American has $3,600 in credit card debt alone, reports USA Today, with average household credit card debt rising 10 percent in just three years. The encouraging news is, if you […]

How to Handle Small Business Taxes

Tax season is a time of jubilation for many people — over half of all taxpayers receive a refund. However, for the self employed, tax time is usually more of a hassle than a pleasure, and paying in is typically the norm. If you want to get a grip on your small business taxes, here […]

This is Why You’re Still Broke

This is a post from Pauline of InvestmentZen.com Have you ever wondered why some people seem to be enjoying life way more than you do, yet never go broke? Yet you are struggling every month to make ends meet, and there is never enough, let alone to plan for the future! Let’s try to see […]