Warning: Parameter 2 to wp_hide_post_Public::query_posts_join() expected to be a reference, value given in /home/fearlessmen/public_html/wp-includes/class-wp-hook.php on line 310

Two weeks ago we talked about Target Retirement Funds and today we’re going to talk about IRA’s (Individual Retirement Accounts). Hopefully this IRA guide will help you understand the difference between a Traditional IRA and a Roth IRA, and you will be another step closer to a retirement savings plan.

Two weeks ago we talked about Target Retirement Funds and today we’re going to talk about IRA’s (Individual Retirement Accounts). Hopefully this IRA guide will help you understand the difference between a Traditional IRA and a Roth IRA, and you will be another step closer to a retirement savings plan.

I’m going to keep this simple and to the point. There are plenty of sites out there full of IRA guide and details………that tend to confuse the average person. Our goal here is to help you walk away feeling confident that your basic knowledge of IRA’s will be enough to guide you towards a decision.

The Traditional IRA came first (Tax Reform Act of 1986) and it is a tax deferred plan. You can contribute up to $5,000 ($6000 if you’re 50 or older) and you can start withdrawing at age 59 ½ but no later than 70 ½.[i]

Advantages:

- Any contributions are tax deductible. If you made $50,000 this year and put $5,000 then you only pay income tax on $45,000.

- A Traditional IRA can be converted to a Roth IRA

Disadvantages:

- All withdrawals get taxed.

- Early withdrawal (before 59 ½) has a 10% penalty on any earnings that have accrued.

- There are 16 exemptions like buying a home for the first time, education, etc…

- You must start withdrawing at 70 ½.

- There are eligibility requirements.

- There are Contribution limits (They usually increase each year just like cost of living).[ii]

The Roth IRA * (Taxpayer Relief Act of 1997) is tax exempt for withdrawals when certain conditions are met. You can contribute up to $5,000 ($6000 if you’re 50 or older) and you can start withdrawing at age 59 ½.[i]

Advantages:

- Withdrawals are tax free. This means all the earnings from interest made off contributions are not taxed. You don’t pay a cent! Do you love the word “Tax exempt” or what?

- Direct contributions are vested after 5 years and can be withdrawn penalty free. There are Roth withdrawal exemptions to this rule.

- Withdrawal is not required at any age. Traditional IRA and 401(k)’s are 70 ½.

- If a Roth IRA owner passes away, the sole beneficiary can keep it along with their own Roth IRA.

- Some employers offer this as a Roth 401(k) and you still receive your company match.

Disadvantages:

- Contributions are not tax deductible (Looking at the above example, you’d still get taxed on $50,000).

- A Roth IRA cannot be rolled back or converted to a Traditional IRA.

- There are contribution limits (They usually increase each year just like cost of living).[ii]

- Early withdrawal (before 59 ½) has a 10% penalty on any earnings that have accrued.

- There are 16 exemptions like buying a home for the first time, education, etc…

The biggest benefit of a Traditional IRA comes when you expect to be in a lower tax bracket during retirement than in your working years.

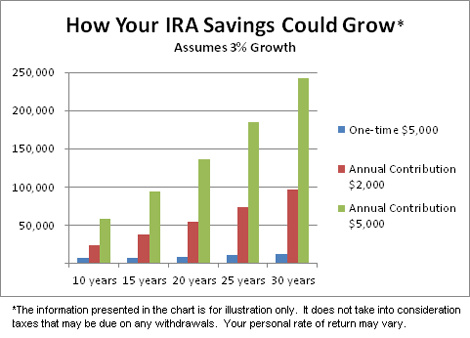

The biggest benefit of the Roth IRA is that everything you make off your contributions is tax free. You could be putting money into it for 30 years and let compounding interest make you money and then withdraw it all and it’s tax exempt. That $240k in the graph above is all yours!

I personally prefer the Roth IRA because everything I earn off interest while it sits is mine when I withdraw it. But the best choice is different for everyone depending on your age, income bracket and other stipulations. For all of us though there are these 2 options in addition to a 401k that we can use.

You might be wondering how much you should you be setting aside biweekly or monthly to reach your retirement goal. There are awesome online calculators available to help you figure it out. Click here for my favorite list. You might be wondering what investment options to put in your IRA. Think of the IRA as a basket and investment options as the eggs. For example, target retirement funds, stocks, index funds, mutual funds, CD’s, etc…. The key is to get yourself a basket. Hope this IRA guide helped. Feel free to ask any questions in the comments below or email.

Editor’s Note: John is not a registered financial advisor and writes from his personal experience through reading, studying and managing his own finances. This is just an IRA guide for your personal knowledge. All of our financial situations are different and this is just a basic introduction for your own personal knowledge.

_____________________________________________________________________________________

[i] IRS on IRA Retrieved 31MAY12

[ii] IRS Contribution limits Retrieved 31MAY12

Hi John, Thank you for explaining the difference between the Traditional and Roth IRA.

I have noticed that company matching plans, when rolled over, need to be rolled into a Traditional IRA to avoid the conversion ‘penalties’ of putting the same money into a Roth.

Good point David! That is important to keep in mind. At my company if you want to roll over from 401 to Roth IRA it’ll get taxed first and then rolled over.