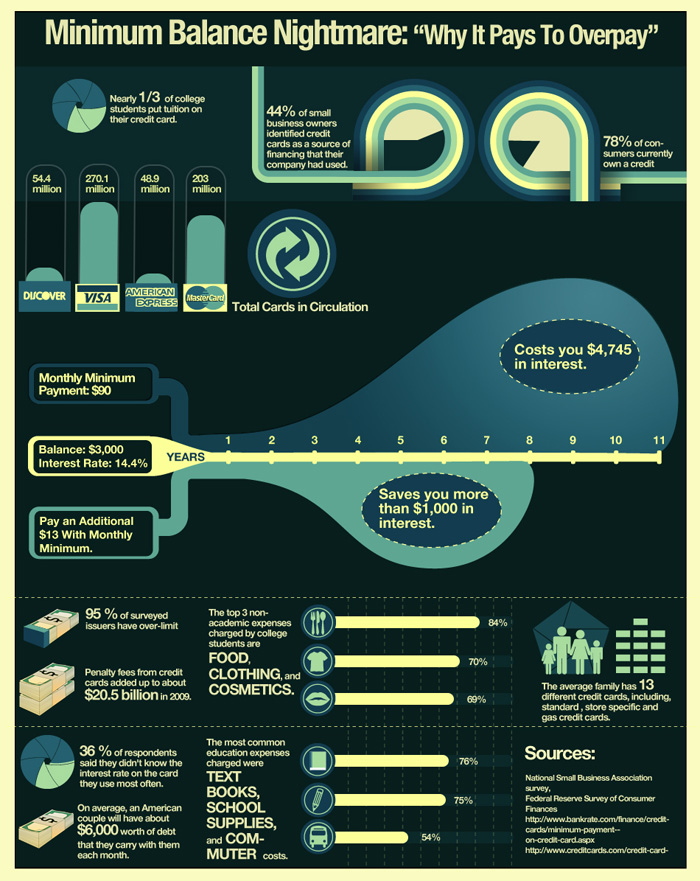

Credit card debt is racking up in many households, and people want to be set free from it. It can kill a man’s present–and future. Don’t get sucked into the cycle of only paying the minimum balance-that’s a nightmare. It pays to overpay, and the below infographic will tell you why.

It Pays to Overpay

Some people rack up debt on credit cards because, unfortunately, they had to. A medical emergency or loss of job may be a legitimate reason to take out what ultimately is just a high interest loan. It’s not immoral, nor is it necessary irresponsible.

Where taking responsibility comes in is being aware of this situation, and choosing to dig yourself out of it. Don’t get sucked into the cycle of the minimum balance nightmare. Just because you can scrape by doing that doesn’t mean it’s a good choice.

As you can see above it’s costly to let high interest debt stick around. Chop it up and get it off your back pronto! It’s not hard. It’s as simple as overpaying your minimum due each month.

Infographic courtesy of killerinfographics.com

The only good credit card balance is a zero balance. Overpaying is the only realistic way to get there. Overpaying also kicks in a good psychology. The moment you make it a goal, a priority, it’s amazing how many bucks crawl out of the woodwork to get that goal accomplished. It’s never an overnight thing, but it is a thrill when you see the balance diminishing, and the shrinking gain momentum.

Not to mention cutting up the card when it’s all done! 🙂

It’s true, overpaying and chopping down that balance does do something good for the psyche.

Back in college, I did have to use my credit card to pay part of my tuition each year. I would charge it and then it would take me all year to pay it off. Then when the next year’s tuition due, I wouldn’t have any cash left to pay the gap in my loans and aid and the cost of in-state tuition and would have to charge it again.

It’s not the best “loan” rate out there, but lots of people have had to do this. And they say college is a pretty good investment :).

I defiantly fall into this problem myself. I currently have around $6000 of credit card debt and am working to pay this off, however one of the big problems I’m having is that I have a little bit of medical debt which isn’t allowing me to get my cards paid down fast enough.

It stinks to carry those balances, but it’s nothing to feel bad about. Medical expenses suck, but what would be worse is not having had the opportunity to get it done.

I wish more people saw graphics like this. So many people just don’t get it when it comes to the cost of CC debt. Like you said, there are situations where it’s a last-resort option. Unfortunately way, way too many people don’t treat them that way. *sigh*

It’s a bummer and people are hurting because of it. Too bad some of those bank bailouts weren’t aimed to help people that got in over their heads–rather than the banks that got in over their heads.

The only time I use a credit card is to rack up points. Not sure if you knew this or not but Suze Orman recently starting promoting credit cards to her viewership as a means to build credit early on.

I use them for the same reason. That’s interesting that she’s advocating the use of them. My dad did when I was 18, and I got my first credit card with a $200 limit then. I had no other way to build credit, and it did teach me responsibility. I’m glad he/I did.

Awesome infographic Todd. If someone is not able to take advantage of offers like 0% interest, they MUST pay more than their minimum payment each month. It’s hard for some people to visualize just how much of a difference it makes.

It’s true, and it’s painful. People really don’t comprehend how they are doubling and tripling what the owe by only paying the minimum!

I like the graphic you used for this article. It is a nice visual to show how paying even a little more makes a big difference in the end. The only time I pay the minimum is when I am focusing my extra funds toward another credit card balance to get it down very quickly.

Thanks! And good call on that. Pay down the highest APR card first!!

Very good infographic. When I have a debt, I tend to over[ay too.It’s better to do that than to increase the balance even more. It’s hard but hard work and determination helps a lot.

Determination is key! To even determine in the first place is pretty critical.